In this post of “Extreme Ads Makeover”, I will be tearing down ads of Chase Bank, on Facebook and have them completely remodeled to have better targeting and ROI.

Check out more ad makeover case studies such as Lexus, Chanel, Chase Bank, Amazon, Starbucks, Nike, Target, Home Depot, and Nature Made.

About Chase Bank

About Chase Bank’s Marketing Agencies

The primary marketing agency for Chase Bank is Inner Circle, an in-house agency that was created in 2019. Inner Circle is responsible for the creative and media strategy for Chase Bank’s marketing campaigns. They also work on product development and marketing initiatives.

In addition to Inner Circle, Chase Bank also works with a number of other agencies, including:

These agencies work together to create a comprehensive marketing strategy for Chase Bank. They use a variety of channels, including TV, digital, print, and social media, to reach their target audience.

About Michael Nguyen – CEO of Produce Results Agency, aka the “Extreme Ads Makeover” Host

Since 1999, Produce Results Agency has helped clients double assets from $5ooM to $1B and generated 4000% ROI for a regional bank turning their $66K marketing budget to $2.8M in revenue.

In this post, I will perform an ad audit on Chase Ads, analyze what’s missing from the ads, come up with new ads, and eventually validate those new ads by running paid traffic on my own dime to see how new ads perform.

I am using Meta Ads in this case study but the same principle applies to other mediums such as Google, Youtube, Programmatic Ads, and short forms.

1. Ads Audit

3. Ads Makeover

6. Next Steps

Promoted Product: Chase Point of Sales

Landing page: https://www.chase.com/business/knowledge-center/manage/pos.

Since Chase can take down this landing page anytime I made a copy of it from this backup link.

Facebook Ads: The Chase team created two ad sets to promote.

What I like:

Room for improvements:

Effect on Ad Performance:

For example: these are Square’s ads on Meta.

Ad 1 (link): focusing on the affordability angle

Ad 2 (link): featuring the mobility angle emphasizing the promise of “taking your store wherever you want to go”.

Here are the disadvantages when having only one control ad:

If you had multiple product lines and currently ran paid ads, there’s a 97% chance that you had less than 3 ads based on my experiences of remodeling ads from Lexus, Chanel, Chase Bank, Amazon, Starbucks, Nike, Target, Home Depot, and Nature Made.

Maybe you are perfectly okay with one control ad and burn your ad budget without ROI.

But if you would like to have a second-opinion ads critique so that you can see the gaps and areas where you can extract MORE juice out of your ads, click on the link below to have me critique your ads.

Audience avatar: Small business owner accepting credit cards

As Jim Collins wrote in his most popular book “Good to Great” – “Begin with an end in mind”, improving Chase’s Facebook Ads wouldn’t start from the ads themselves.

Instead, I would start from the landing page to where Chase sends prospective customers. By analyzing the landing page, I know what’s missing so that I can work backward to improve the ads.

Using the power of AI, I will be applying 7 different lenses (or analysis models) to analyze Chase’s landing page so that you understand what’s missing.

Let’s goooooo…..

From the landing page, I came up with the Text Personality profile.

Text Personality Profile

– Expository: The text primarily aims to inform the reader about POS systems in a methodical manner, breaking down their features, benefits, and considerations.

– Educational: The tone and language used aim to provide a deeper understanding of the subject to the audience, which presumably consists of individuals not fully acquainted with the intricacies of modern POS systems.

– Neutral-Positive: While primarily informative, the text occasionally adopts a positive tone, especially when highlighting the benefits of modern POS systems.

– Encouraging: Phrases like “Get started” and the mention of it being an “exciting time” aim to motivate the reader to consider their options.

– Technical Jargon: Terms such as “smart POS”, “merchant services provider”, “digital payments”, “integration”, and “cloud-based system” appear throughout the text.

– Conversational Elements: Phrases like “Not so long ago” or “Get started by answering these five questions” give the content a more conversational and approachable feel.

While the Chase team chose to break down the features and benefits of their POS system, here are some missing angles that would resonate more with the customer avatar that Chase is trying to reach.

– Emphasize cost-effective solutions tailored for small businesses, ensuring they don’t have to spend much to get a top-notch system.

– Stress the flexibility of modern POS systems that can grow with their business, catering to expanding operations without needing constant replacements.

– Discuss how a good POS system can help small business owners offer a more personalized shopping experience, building customer loyalty and repeat business.

– Elaborate on how POS systems help small businesses manage their stock efficiently, ensuring they don’t over-order or run out of popular products.

– Introduce features or apps within POS systems that allow businesses to engage with local communities, promoting local events or partnering with other small businesses for promotions.

– Mention the ease with which staff can be trained on these systems, saving time and ensuring smooth transactions for customers.

– Given that small businesses may not have extensive IT teams, emphasize the robust security features that protect customer credit card data.

– Highlight the potential integration with local delivery services, especially crucial in the current market where delivery options are highly valued.

– Include testimonies from other local small businesses, discussing the benefits they’ve seen since adopting the system.

– Mention that small business owners can get local support, ensuring that they have someone to turn to if they encounter any problems or have queries.

By implementing these suggestions, the content will be more aligned with the needs, preferences, and concerns of small business owners looking to accept credit card payments.

Anticipating objections is one of the most overlooked analyses that most agencies don’t bother to work on. Yet, when you have more insights into logical, emotional, and practical objections in their heads preventing them from going forward, making sales is so much easier when you find a way to remove those barriers.

In this analysis, I’ll break down 3 categories of objections where the landing page does a good job and where it falls short.

– Complexity and Learning Curve: The description of both traditional and smart POS systems suggests that there might be a steep learning curve for individuals who aren’t tech-savvy. Business owners may feel overwhelmed with the numerous features and integrations mentioned.

– Security Concerns: While the text mentions connecting to bank accounts, tracking sales, and storing customer data, it doesn’t emphasize the security features. Business owners could be concerned about the safety of financial transactions and the storage of sensitive customer data.

– Reliability of Wireless Systems: The mention of slow internet connections or locations with spotty cell service potentially causing delays in sales processing could be seen as a significant drawback. Owners may question the feasibility of adopting such systems if their area has unstable internet connectivity.

– Fear of Change: The contrast between the old bell-ringing cash registers and the modern, feature-rich POS systems may invoke a sense of nostalgia and resistance to changing what might be working just fine for some businesses.

– Overwhelm with Choices: With the array of options and considerations provided (traditional vs. smart, integrations, payment methods), a business owner might feel paralyzed by too many choices and prefer to maintain the status quo.

– Cost Implications: The text doesn’t provide clear information about the cost of acquiring and maintaining these POS systems. Small business owners might be concerned about the financial implications of implementing a new system, especially if there are transaction fees, setup fees, or monthly costs involved.

– Integration Limitations: For businesses that already use specific software for accounting, inventory, or CRM, there may be concerns about how seamlessly the suggested POS systems would integrate with their existing tools.

– Potential Hardware/Software Redundancies: If a business has recently invested in a system, they may see the proposed POS solutions as redundant or unnecessary.

Here are additional objections that the prospective customers could raise:

– Long-term Support and Updates: Business owners might question the longevity of support and regular updates for the POS systems, ensuring that they remain compatible with evolving technologies.

– Vendor Lock-in: There could be concerns about being locked into a particular service provider, especially if switching providers in the future becomes complex or costly.

– Customization Limitations: The text doesn’t specify if the POS systems can be customized to cater to niche business needs or specific industry requirements.

– Physical Space and Installation: Business owners might wonder about the physical space required for these systems and the potential disruption during installation.

– Contractual Obligations: There might be questions about the length of contracts, early termination fees, or other hidden costs not mentioned in the text.

– Scalability Concerns: As businesses grow, owners might be concerned about the system’s ability to scale and handle increased transactions without performance issues.

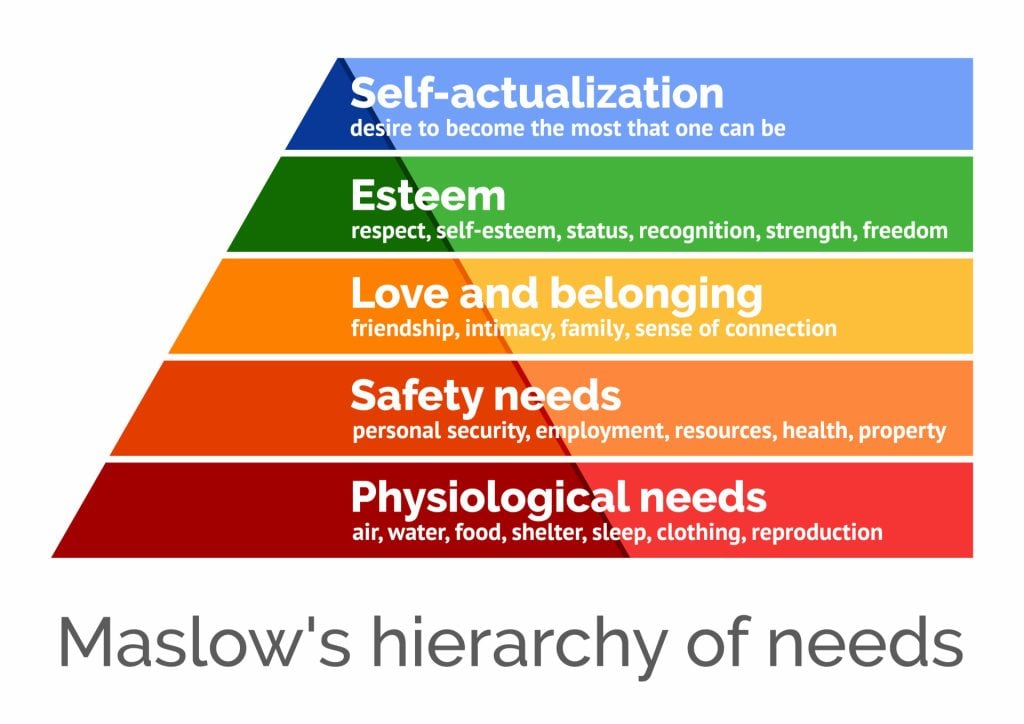

Maslow’s hierarchy of needs is a motivational theory in psychology comprising a five-tier model of human needs, often depicted as hierarchical levels within a pyramid.

From the bottom of the hierarchy upwards, the needs are physiological (food and clothing), safety (job security), love and belonging needs (friendship), esteem, and self-actualization.

Needs lower down in the hierarchy must be satisfied before individuals can attend to higher needs.

– Reliable connection, ensuring that business transactions go through without hitches. (Mentioned multiple times: reliable connection, the speed and reliability of a wired connection, storing data on your own servers for access even if the internet is down.)

– Secure credit card processing, ensuring the safety of financial transactions. (Mentioned once: secure credit card processing)

– Fair and transparent pricing for payments. (Mentioned once: look for fair and transparent pricing)

– Being able to offer better service to customers, elevating the business’s reputation. (Mentioned multiple times: provide fast and convenient service, POS system helping in offering better services, the ability to offer loyalty rewards, suggest new products, send targeted emails, etc.)

– POS being the front line of the business, which might boost the business owner’s pride and confidence in their operations. (Mentioned once: POS system is the front line of your business.)

– Turning the POS system into a strategic hub, implying that it can help the business reach its fullest potential. (Mentioned once: turn your POS system into a strategic hub)

– The ability to develop new or more effective sales strategies, signifying growth and betterment. (Mentioned once: develop new or more effective sales strategies)

Maslow’s Hierarchy of Needs NOT Present but Could Appeal to Small Business Owners Accepting Credit Cards:

– Offerings that reduce physical effort or save time, which indirectly relates to physiological comfort. For example, a lightweight, compact design that doesn’t consume much space.

– Building a community of users where business owners can share experiences, give feedback, and learn from one another.

– Offering personalized customer service experiences, where the business feels valued and part of a larger group of satisfied customers.

– Offering elite or premium versions of the POS service for businesses that want to differentiate themselves.

– Including testimonials or success stories of businesses that have grown or benefited immensely from the POS system.

– Advanced analytics or features that not only help in running the business but also in evolving and envisioning future strategies.

– Training or workshops aimed at helping business owners leverage the full potential of the POS system.

To fully address the needs and concerns of small business owners, it would be valuable to incorporate these missing elements in the promotional content about the POS system.

– Inconvenience of not making sales on the go: Traditional POS often requires a wired connection, restricting mobility. (Mentioned once)

– Inability to offer desired customer services: Not all POS systems store customer data or have loyalty programs. (Mentioned once)

– Potential limited functionality: Earlier, POS was just a cash register with minimal features. (Mentioned once)

– Overwhelming choice: Many potential features to consider in a POS system. (Mentioned once)

– Traditional POS systems might not integrate easily: Integrations can be challenging. (Mentioned once)

– Traditional POS might not allow for diverse payment options: Some POS systems might be limited to certain payment methods. (Mentioned once)

– Potential challenges with fair and transparent pricing: Some payment methods might have higher transaction fees. (Mentioned once)

– Lack of clarity in payment structure: The payment structure could be confusing. (Mentioned once)

– Fear of making the wrong choice: So many potential features to consider. (Mentioned once)

– Concern about not having access to business data remotely: Not all POS systems offer cloud storage. (Mentioned once)

– Worry about not being able to provide the latest payment options: Traditional POS might not support all digital payment methods. (Mentioned once)

– Fear of not being competitive: Not using POS to its fullest potential. (Implied but not explicitly mentioned)

– Waiting due to slow connections: Slow internet or spotty cell service can delay transactions. (Mentioned once)

– Difficulty in understanding pricing: Need to ask providers to explain their pricing. (Mentioned once)

– Integrations not being straightforward: Need to implement new code for certain integrations. (Mentioned once)

– Limitations of traditional POS: Restricted to wired connections or not having certain features. (Mentioned multiple times)

– Doubting reliability of wireless systems: Concern about sales going through with wireless connections. (Mentioned once)

– Storing data off-site: Risk of not accessing data if the internet is down. (Mentioned once)

– Uncertainty about merchant services providers: If they can’t explain their pricing, considering other options becomes a possibility. (Mentioned once)

– Not sure about integration possibilities: Uncertainty about whether integrations are already set up. (Mentioned once)

Sentiments Not Present but Could Appeal to Small Business Owners Accepting Credit Cards:

– High transaction fees reducing profits.

– Difficulty in tracking sales and managing inventory without a POS.

– The stress of manual accounting and sales tracking.

– Time-consuming training or steep learning curves for new systems.

– Inconsistent customer data leading to inefficient marketing.

– Difficulty in offering promotions or loyalty programs without proper data.

– Manual reconciliation of sales and inventory.

– Limited insights into customer behavior and preferences.

– Fear of technological obsolescence.

– Anxiety about data breaches or security issues.

– Worry about system downtimes during peak business hours.

– Concerns about compliance and regulatory issues.

– Feeling tied down to one location due to wired systems.

– Lack of customization or adaptability for unique business needs.

– Having to switch between multiple systems for different tasks.

– Inefficient customer support when issues arise.

– Uncertainty about future software updates or support.

– Risks associated with choosing lesser-known brands or new entrants.

– Doubts about long-term costs and potential hidden fees.

– Uncertainty about integration with other existing business systems.

Including these sentiments in promotional or explanatory content would make it more comprehensive and relevant to the concerns and needs of small business owners.

While the Negative Sentiment gives us insight into what drives small business owners away, for the Positive Sentiment analysis, I am looking for what can lead to desire, hopes, and dreams of what they are looking for in POS solutions.

– Turn POS system into a strategic business hub (1 instance)

– Track sales and inventory (1 instance)

– Provide fast and convenient service (1 instance)

– Choose the right POS system for business needs (1 instance)

– Connect to bank account seamlessly (1 instance)

– Access business data remotely (1 instance)

– Understand payment structures and pricing (1 instance)

– Integrate POS with other business systems (1 instance)

– Process credit cards and digital payments (2 instances)

– Access additional tools and information through apps (1 instance)

– Take payments on the go (1 instance)

– Sync and pass data between different systems (2 instances)

– More advanced features in the POS system compared to older systems (1 instance)

– Mobility and flexibility in processing payments (2 instances)

– Ability to easily integrate with other systems (2 instances)

– Improve customer relationship and retention (2 instances)

– A strategic hub that more than just processes payments (1 instance)

– Real-time adjustments to inventory (1 instance)

– Tracking success of marketing campaigns through integrated data (1 instance)

– Offering loyalty rewards and targeting customers effectively (1 instance)

– Ability to offer loyalty rewards (1 instance)

– Suggest new products based on past customer data (1 instance)

– Fast and straightforward integration capabilities (1 instance)

– Verification of in-stock products and holding them for customers (1 instance)

– Building trust with transparent pricing from merchant services providers (1 instance)

– Improving customer loyalty with targeted marketing efforts (2 instances)

– Responding quickly to customer needs (1 instance)

– Connecting businesses with Payments Advisor (1 instance)

Sentiments Not Present but Could Appeal to Small Business Owners Accepting Credit Cards:

– Confidence: Assurance that adopting new technology would be a seamless process.

– Security: Strong emphasis on protecting customer data and financial transactions.

– Simplicity: Ease of use and user-friendly interfaces, minimizing the learning curve.

– Affordability: Cost-effective solutions tailored for small businesses.

– Community: Being part of a network or community of business owners sharing insights and best practices.

– Support: Ongoing customer service and tech support to address challenges swiftly.

– Updates: Continuous updates and improvements to stay ahead of technological advancements.

By understanding these sentiments, businesses can tailor their offerings and communications to resonate more deeply with their target audience, in this case, small business owners accepting credit cards.

The late great sales trainer, Zig Ziglar, used to say, “People buy on emotion and justify on logic.” Wouldn’t it make sense to understand what logical sentiments small business owners are using to make justification and how they make decisions on emotion?

That’s exactly why in this analysis, the landing page is carefully analyzed to look for decision-making logical patterns as well as emotional patterns to see what the gaps are.

Logical Sentiments

– “It’s the front line of your business.” (Identification Logic: Defining the role of a POS system in a business)

– “Traditional POS systems operate specific point of sale software on a computer and save data to a hard drive.” (Categorization Logic: Differentiating traditional POS systems)

– “With so many potential features, there’s a lot to consider when choosing a POS system.” (Decision-making Logic: Recognizing the complexity of choosing the right POS)

– “Traditional POS systems often require a wired connection…” (Comparison Logic: Contrasting traditional and smart POS systems)

– “When considering merchant services providers, look for fair and transparent pricing…” (Evaluation Logic: Providing guidance on how to assess a service)

– “Many software providers offer built-in integrations.” (Causation Logic: Explaining the availability of integration options)

– “The big advantage of a traditional POS is the speed and reliability of a wired connection.” (Cause and Effect Logic: Highlighting the benefit of a specific feature)

– “They may also enable you to take payment information and store it offline and then process payments once you have access to a phone line…” (Sequential Logic: Describing a sequence of events in offline payment processing)

Logical Sentiments Missing but Should Be Present:

– The long-term cost savings of digital vs. traditional POS systems.

– The ease or difficulty of training staff to use a new POS system.

– Data security and customer information protection features.

– Future-proofing businesses: How adaptable are these systems to future tech advancements?

Emotional Sentiments

– “Not so long ago, a point of sale system (POS) system was a cash register whose “bells and whistles” included an actual bell. Today, business owners can expect a lot more.” (Nostalgia: Reflecting on simpler times and progression)

– “Many business owners now run their businesses through their POS.” (Trust: Relying heavily on technology)

– “If they can’t, consider a different option.” (Distrust: Suggesting caution and skepticism)

– “A smart POS uses apps, which allow it to easily pass data back and forth between systems.” (Appreciation: Valuing convenience and integration)

– “A POS system can do more than process payments. Many now include features that customers love…” (Affection: Positive feelings toward the versatility of modern POS systems)

– “It’s an exciting time to consider a new POS system.” (Excitement: Anticipating the benefits of newer systems)

Emotional Sentiments Missing but Should Be Present:

– Peace of mind for business owners knowing that transactions are secure and reliable.

– The pride and prestige associated with owning a state-of-the-art POS system.

– Relief in knowing that support and assistance are available when navigating POS complexities.

– Frustration prevention, suggesting that a better POS can prevent common business hiccups.

Psychographics is the study of consumers based on their activities, interests, and opinions (AIOs). It goes beyond classifying people based on general demographic data, such as age, gender, or race. Psychographics seeks to understand the cognitive factors that drive consumer behaviors.

Based on Chase Landing page, there are 6 primary psychographic groups based on the usage pattern of POS system.

6+ Primary Psychographics

– “Do you need to make sales on the go? Traditional POS systems often require a wired connection, although some work with wireless card readers that allow you to move around your space or process transactions off-site.”

– “What kinds of payments do you need to take? Many traditional POS systems and all smart POS systems integrate digital payment options and allow customers to swipe, dip, tap or scan their payment of choice.”

– “Do you want to integrate your POS with other systems? Integrations can be challenging for traditional POS systems but are usually possible.”

– “Fast, straightforward integrations also can help you analyze your sales figures and collect customer data in your CRM system so that you can develop new or more effective sales strategies.”

– “How can your POS system help you offer better service? A POS system can do more than process payments. Many now include features that customers love and that can help you run your business more effectively.”

– “Do you have a reliable connection? The big advantage of a traditional POS is the speed and reliability of a wired connection.”

The text from the landing page paints a picture of business owners or decision-makers who are tech-savvy, customer-focused, and keen on enhancing and modernizing their operations. They are also depicted as being diligent in their research, wanting to understand and weigh their options before making an investment.

Over the years of writing copies and launching marketing campaigns for clients, there’s a list of desires that humans want to achieve. For example:

Need: Satisfy an intense need for something.

Survival: Live a long and healthy life

Protection: Safety, care and protection for yourself and loved ones

Freedom: Freedom from danger, fear and pain

Comfort: Comfortable living conditions

and many others.

The goals of this analysis are two-fold:

6 Primary Desires

– “It’s the front line of your business. It’s not just where you can process credit cards and digital payments. It’s also how you can connect to your bank account, track sales and inventory, and provide fast and convenient service.”

– “Many business owners now run their businesses through their POS.”

– “Traditional POS systems often require a wired connection, although some work with wireless card readers that allow you to move around your space or process transactions off-site.”

– “A smart POS uses apps, which allow it to easily pass data back and forth between systems.”

– “With these integrations, many businesses are able to see sales data in their accounting software, get real-time adjustments to their inventory or quickly deposit funds into their bank accounts.”

– “On the other hand, smart POS systems often connect through Wi-Fi or a cellular network for secure credit card processing across the street or the country.”

– “Do you want to integrate your POS with other systems?”

– “Fast, straightforward integrations also can help you analyze your sales figures and collect customer data in your CRM system so that you can develop new or more effective sales strategies.”

– “A POS system can store customer data, allowing you to offer loyalty rewards based on dollars spent or points earned.”

– “The big advantage of a traditional POS is the speed and reliability of a wired connection.”

Sentiments Not Present But Should Be

A cognitive bias is a systematic error in thinking that occurs when people are processing and interpreting information in the world around them and affects the decisions and judgments that they make. According to the Cognitive Bias Codex, there are an estimated 180 cognitive biases (this list is frequently updated.) For example, there are some biases you may be familiar with:

A deep grasp of the psychological underpinnings that drive human attention, perception, and decision-making can greatly increase the effectiveness of ad campaigns. Here’s how understanding human biases can help:

People are more likely to remember the first and last things they see. Designers can capitalize on this by placing the most important elements, such as the call-to-action or brand logo, in positions that take advantage of this bias. This principle is often applied in landing page designs, video ads, and carousel advertisements.

People are influenced by experts or authoritative figures. Incorporating endorsements or expert opinions in an ad can help sway potential customers. In the design, this can manifest as strategically placing these endorsements where they are most likely to capture attention.

The bandwagon effect or social proof bias means people are more likely to do something if they see others doing it. Incorporating elements that indicate wide acceptance or popularity, such as customer testimonials, star ratings, or the number of products sold, can make ads more compelling.

People are not always rational; emotional biases often override logical thinking. Design elements like color, imagery, and typography can evoke specific emotions that align with the ad’s message. For example, using warm colors like red or orange can trigger excitement or urgency, which could prompt quick decision-making.

People are generally more motivated by the fear of losing something than by the prospect of gaining something of equal value. Adding time-sensitive offers, limited quantities, or exclusive deals can make an ad more compelling. Designers should highlight these elements visually to draw attention to them.

People rely heavily on the first piece of information they receive when making decisions. Price anchoring is a common technique, where a higher price is first shown next to the discounted price, making the latter seem like a bargain. The design should make this contrast visually striking.

People tend to want to return favors. Offering something of value in the ad—like a free e-book, a discount, or valuable insights—creates a sense of obligation in the viewer. The design should make this offer stand out.

People prefer things that are easy to think about and understand. Keeping the design uncluttered, using simple language, and providing clear calls to action fall under this category.

By acknowledging these biases, we can create layouts, use colors, and choose typography and imagery that aligns with these cognitive triggers, ultimately leading to higher conversion rates and more effective advertising campaigns.

Cognitive Biases

– Bias: Narrative Fallacy – The text constructs a narrative that illustrates a story of technological progress in POS systems.

– Bias: Herd Mentality – By stating that many business owners now use POS systems in this way, it implies that this is a common or popular behavior to adopt.

– Bias: Framing Cognitive Bias – This statement is framed in a way that implies that if a provider can’t explain their pricing simply, they might not be a good choice.

– Bias: Overconfidence Bias – This sentence seems sure of the superiority of the traditional POS in terms of speed and reliability. It doesn’t provide comparative data to support this claim.

– Bias: Framing Cognitive Bias – This statement is framed positively to make the process of considering a new POS system seem appealing and timely.

Sentiments not present but could appeal to small business owners accepting credit cards:

There is a lot to absorb based on my 7 analysis models.

For brevity, I’ll pick out 3 models and improve the landing page & create new sets of Facebook ads based on what I recommend.

I would leave the remaining 4 analyses as homework for Chase team or they can reach out to me and we can gladly continue the work on the remaining 4 models on a retainer basis.

Landing page Rewrite: I am going to rewrite a new version of the landing page with emphasis on Highlighting Affordability

Unlock the Magic: Make Your POS the Affordable Powerhouse of Your Business

Picture this: Once upon a time, the charm of a point of sale system (POS) was a quaint bell that signaled a sale. Now, that humble register has evolved into a commanding force that not only hears the cha-ching but also streamlines your operations in a digital arena. With an affordable investment, witness the metamorphosis of your business.

Dive into the heart of the digital age with a POS that stands as the vigilant guardian of your business. Beyond mere transactions, it’s a shimmering portal, granting you direct access to your bank vault, sales analytics, and inventory in real-time. It’s no wonder that savvy business owners have seamlessly integrated their operations via their POS.

While the traditional POS, steadfast and reliable, functions through specific software and stores treasures on a hard drive, the modern, smart POS sparkles with the brilliance of a smartphone. With a treasure trove of apps at your fingertips, you can reach out and touch vast realms of data and tools without breaking the bank.

Embarking on this journey? Pose yourself these golden questions:

– Wish to Conquer Territories On-the-Move?

While the old-world charm of traditional POS demands a tethered connection, some have adapted, allowing you the freedom to roam with wireless connections. Yet, the majestic smart POS, affordable yet grand, connects through the invisible threads of Wi-Fi or cellular networks, giving you the power to process transactions from any corner of the world.

– Which Coins and Currencies Do You Wish to Accept?

Both the traditional stalwarts and the gleaming smart POS open the gates to a myriad of payment methods. Seek providers who offer clear, affordable, and transparent treasures without hidden dragons. If they talk in riddles, set your sights elsewhere.

– Dream of Interlinking Your Kingdom’s Systems?

While old guard POS might require wizards to integrate, the smart POS, with its app-driven magic, integrates effortlessly. Watch as your sales data paints a masterpiece, or let your inventory adjust in real-time, all without draining your coffers.

– How to Dazzle Your Subjects with Stellar Service?

The modern POS is no mere payment conduit. It’s a gilded chest brimming with features. Enchant your customers with personalized offerings and cast a spell with targeted messages, all while ensuring the best value for your precious gold.

– Do You Have the Steed for a Steady Journey?

The strength of the traditional POS lies in its unwavering wired connection, ensuring a speedy voyage. However, should you face treacherous terrains with unstable connections, some systems come armed with both wireless prowess and backup dial-up.

Embark on This Grand Quest

In this vibrant era, choosing a POS is an adventure filled with promise. Be it the unyielding reliability of the old guard or the nimble grace of the cloud warriors, your quest awaits. Venture forth to Chase Payment Solutions℠, and let your saga begin!

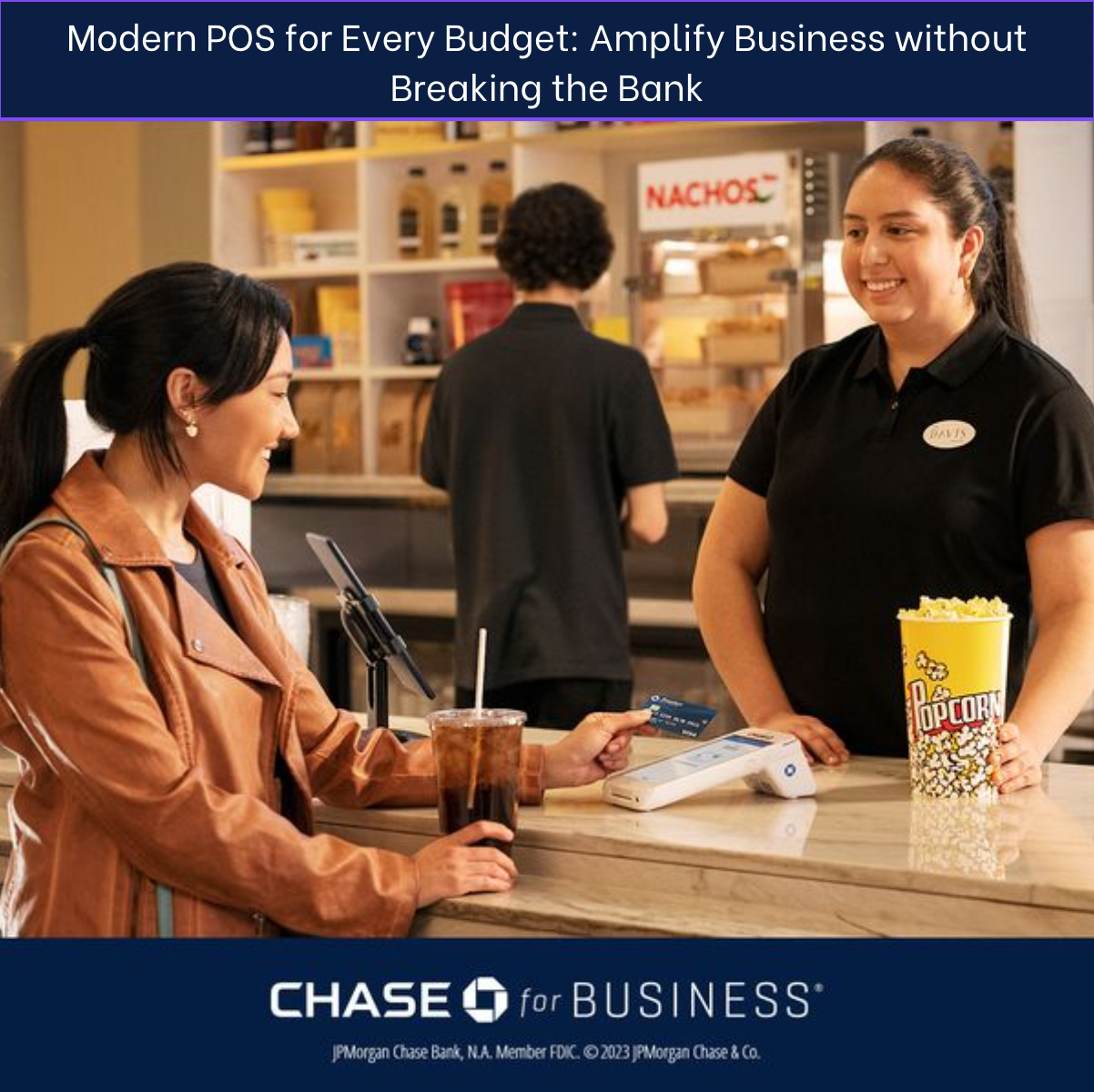

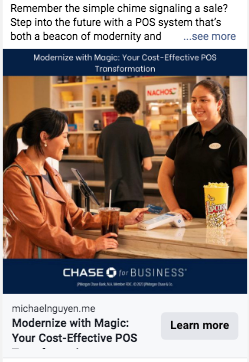

Facebook Ads Concepts for Highlighting Affordability

Headlines

Ad Copies

Landing page Rewrite: one of the objections not clearly addressed in Chase’s original landing page is the concern about “Cost Implication”, the cost of acquiring and maintaining these POS systems. Small business owners might be concerned about the financial implications of implementing a new system, especially if there are transaction fees, setup fees, or monthly costs involved.

A Budget-Friendly Upgrade for Small Businesses: The Modern POS System

In an evolving business world, remember when the ‘ring’ of cash registers signified sales? Today, it’s not just about the sound; it’s about the efficiency and cost-effectiveness of the system behind it.

Embrace the digital age with a POS system that understands both the scale and the budget of a small business. Think beyond just another expense. Envision a strategic investment that enhances your sales process, links seamlessly with your bank, tracks your inventory, and elevates the service you offer—without breaking the bank.

Old-school POS systems, while dependable, function like analog tools in a rapidly digitizing world. Contrast that with today’s ‘smart’ POS, which offers a plethora of features at a fraction of the expected cost, making them tailor-fit for small businesses. Plus, with instant access to countless apps and tools, informed decision-making is just a tap away.

Concerned about the financial commitment? Let’s address that:

- Affordable Entry & Transparent Pricing: Dive into the world of modern POS without the hefty price tags of the past. Our solutions offer transparent, upfront pricing, devoid of hidden charges or confusing terms. Know exactly what you’re paying for, and why.

- Maximize ROI: The efficiency gains, sales insights, and customer experience enhancements you’ll achieve with a modern POS system mean that your initial investment will pay for itself in no time. It’s not just about accepting credit cards; it’s about refining your entire business process.

- Cost-effective Integrations: With our modern systems, gone are the days of expensive integrations. Connect effortlessly with other business tools and systems, bringing together sales, accounting, inventory, and more without the high integration costs of traditional systems.

- Savings through Efficiency: A modern POS does more than just process payments. With features like inventory tracking and customer insights, reduce overheads, avoid stock wastage, and understand client preferences to offer targeted promotions—saving money while driving revenue.

- Stay Competitive without Overspending: In today’s business landscape, accepting credit cards is no longer a luxury—it’s a necessity. But that doesn’t mean it should come with an exorbitant price tag. Our POS solutions ensure you stay competitive while remaining financially prudent.

Make the Leap: Switching to a modern POS system isn’t merely about keeping up with the times; it’s about being strategic with your resources. With Chase Payment Solutions℠, make the transition smooth, affordable, and, most importantly, beneficial for your business’s bottom line. Embrace the future of transactions, optimized for small business budgets.

Facebook Ads Concepts for addressing the cost implication.

Headline Options:

Ad Copy:

Landing page Rewrite: I am going to rewrite a new version of the landing page with emphasis on the category of “business owners who prioritize mobility in their business operations“

Unlock Boundless Horizons with Mobility-Driven POS!

Step into the future, where your POS isn’t just a business tool—it’s the lifeblood of your unshackled, ever-moving enterprise.

Remember the quaint jingle of the traditional cash register? Fast forward to today, where the digital symphony of the new-age POS sings tales of uninhibited movement. Your business deserves more than static operations. Picture this: Closing a lucrative deal as you sip your coffee at a café downtown or clinching a pivotal sale as you wander through a trade fair in another city.

Are You Ready to Unleash the True Power of Mobility?

- Anywhere, Anytime Sales: Traditional POS had you tied down, bound by cords and connections. Now, envision a world where your business transcends borders, where every corner of the globe is a potential sales point. With smart POS systems, the world truly becomes your marketplace—untethered and unlimited.

- Seamless Payment Experiences: Dive into the digital age, where payments aren’t just about swipes and dips. Be it an impromptu sale at a local market or a mega transaction on the opposite coast, smart POS ensures your transactions are swift, secure, and seamless.

- Integration Like Never Before: Let’s talk magic—where your POS effortlessly converses with your inventory, CRM, and accounting systems. Imagine real-time data at your fingertips, giving you insights as you hop from one city to the next.

- Transform Customer Service: Create memories, not just sales. Delve deep into the desires of your clientele, offering personalized product recommendations even when you’re miles away. And as they leave with a smile, give them the choice—digital receipts that echo your business’s eco-friendly ethos.

- Stellar Connectivity: Reliability isn’t just about strong connections—it’s about persistent ones. Why limit yourself to one mode when you can switch between wired efficiency and wireless wonders?

Embark on Your Unchained Journey! This is your clarion call—unshackle your business aspirations from static confines. Whether you desire the stalwart reliability of a traditional system or the whimsical wonders of the cloud, the world awaits your conquest. Dive deep with Chase Payment Solutions℠ and soar the limitless skies of mobile commerce.

Facebook Ads Concepts for “People who prioritize mobility in their business operations“

Headline Options:

Ad Copy:

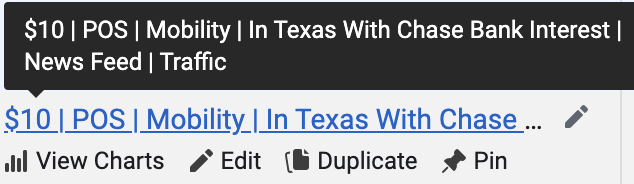

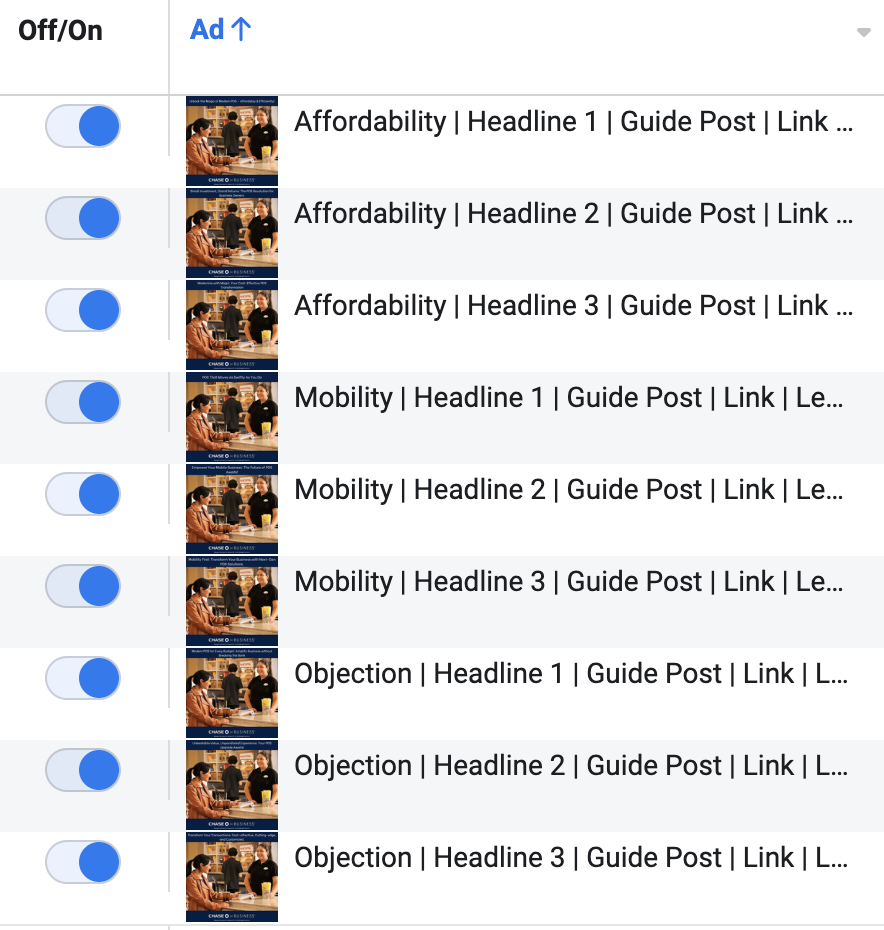

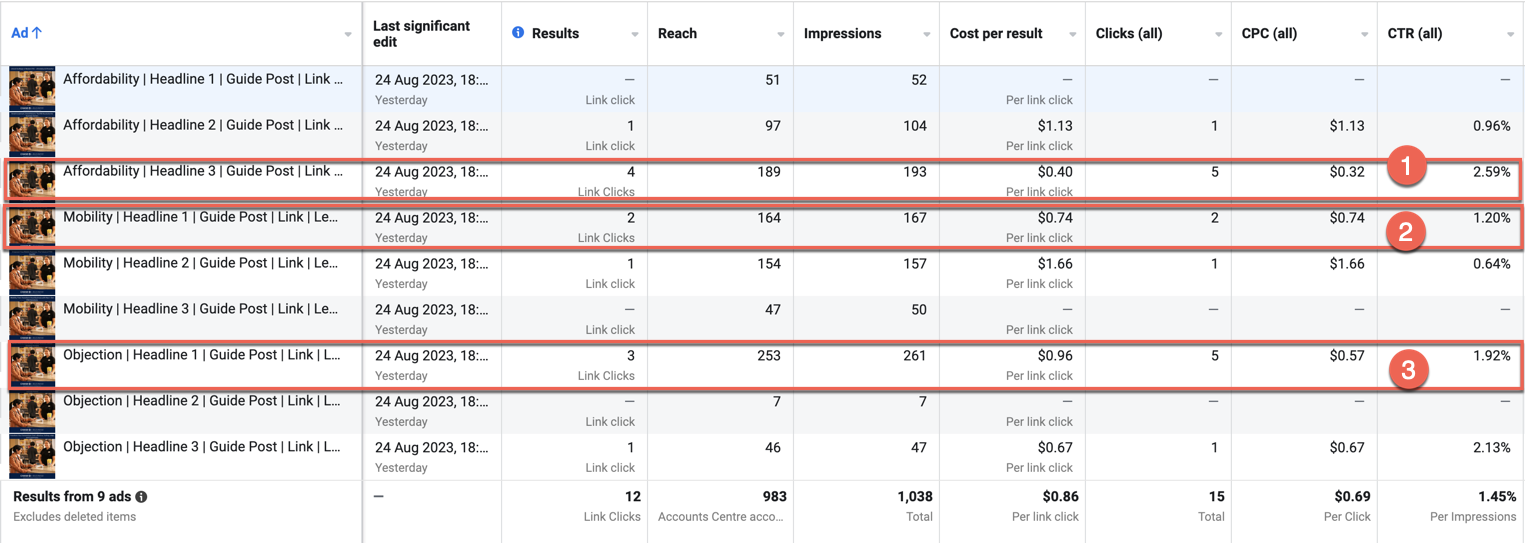

This is where the rubber meets the road as I am going to validate ad concepts from the previous step by running paid traffic to see which ad concepts would resonate most with the customers.

There will be 3 ad sets:

Adset 1:

Goal: Highlighting Affordability of the POS system

Landing page: https://michaelnguyen.me/make-your-pos-the-affordable-powerhouse/

Headlines

Ad Copies

Ad Creatives:

Instead of creating new creative, I decided to use the existing one and focus on the copy instead.

However, having multiple creatives matching the ad message boosts the performance.

Here’s how I set the adset on Facebook

Adset 2:

Goal: Addressing the “cost implication” objection

Landing Page: https://michaelnguyen.me/the-modern-pos-system

Headline Options:

Ad Copy:

Here’s how I set the adset on Facebook

Adset 3:

Goal: Meet the expectation of the group of “People who prioritize mobility in their business operations“

Landing Page: https://michaelnguyen.me/mobility-driven-pos

Headline Options:

Ad Copy:

Asset:

Here’s how I set the adset on Facebook

Here are all the 9 ads being launched.

Fast-forwarding 24 hours to let the ads run.

O: Objection

A: Affordability

M: Mobility

As you can see, whether you are in the worst case or sub-par scenario (under 2% industry standard), you are still ahead in term of ROI (134% – 22,440%).

So in this thorough case study, I extensively analyze, examine, and audit Chase’s ad relating to the POS system, then come up with new ad ideas based on 7 analysis “lenses”, and finally validate ad ideas by running them through paid FB traffic to determine the winning ad.

If you are a 7-figure business owner and already run paid ads and need someone to critique your ads for a potential makeover, go ahead and order my “Second Opinion” package.